Instigating the Economic Crime and Corporate Transparency Act 2023 (ECCTA 2023) into legislation within the United Kingdom represents a landmark moment in the government's ongoing efforts to combat economic crime and improve its legislative framework. One of the key provisions of this legislation is introducing a ‘failure to prevent fraud’ offence, which seeks to hold organisations accountable for fraud committed by individuals associated with them.

The Need for Ethical Standards

Large organisations and their subsidiaries often wield significant influence and power, both economically and socially. As such, they are responsible for conducting their business operations in a manner that not only complies with legal regulations but also aligns with the highest ethical standards. The ECCTA 2023, amongst other areas of legislation, aims to create a level playing field and promote fair competition in the marketplace by implementing offences that hold these organisations accountable for any wrongdoing or unethical behaviour.

Partnerships, on the other hand, are often characterised by shared responsibilities and decision-making among partners. All partners must uphold ethical standards and adhere to the law to maintain the integrity of the partnership and the trust of their clients and customers. Including partnerships within the scope of the offence ensures that all entities, regardless of their legal structure, are held to the same standards of conduct.

In addition, including large not-for-profit organisations such as charities and incorporated public bodies within the scope of the offence is a positive development. These organisations play a crucial societal role by providing essential services and support to vulnerable populations. They must operate transparently and be accountable for maintaining public trust and confidence. By subjecting them to the same standards as for-profit organisations, the legislation ensures that all entities, regardless of their profit motive, are held to the same high standards of conduct.

The Failure to Prevent Fraud Offence

Introducing this offence marks a significant shift in the approach to combating economic crime. Previously, organisations could only be held criminally liable for fraud if it could be proven that senior management or the organisation's directing minds were involved or aware of the fraudulent activities. This high threshold often made it difficult to prosecute organisations for fraud, especially in cases where lower-level employees or third parties committed the offence.

With the ‘failure to prevent fraud’ offence, the liability scope for organisations has significantly expanded. Now, organisations can be held criminally liable for fraud committed by anyone acting on their behalf, including employees, agents, and contractors. This expansion pressures organisations to implement robust fraud prevention measures and monitor the actions of those associated with them.

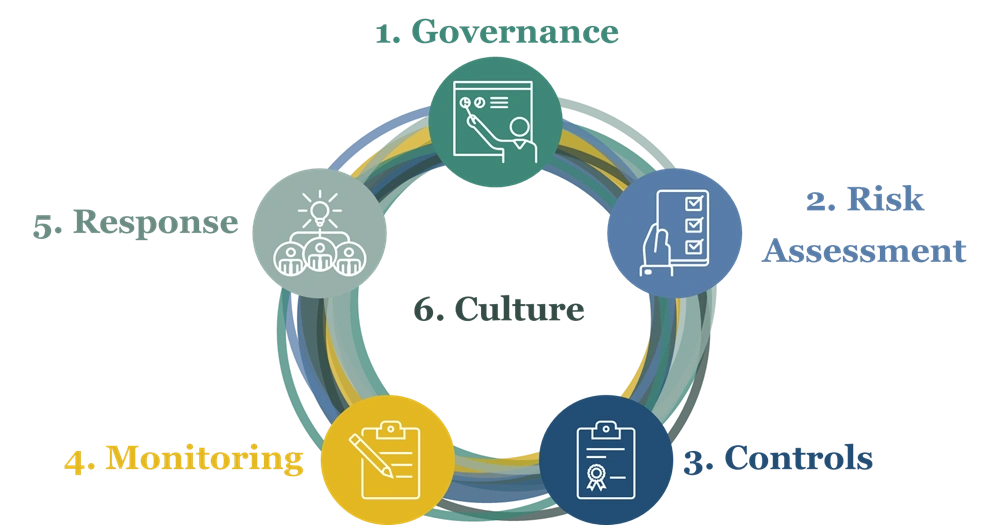

Introducing the 'failure to prevent fraud' offence necessitates a significant review and strengthening of organisations' anti-fraud policies and procedures. Organisations must ensure that their standards, policies and procedures effectively deter and detect fraudulent activities. This may involve:

- Implementing stricter internal controls.

- Conducting regular fraud risk assessments.

- Providing employee fraud awareness training, and

- Actively monitoring and investigating suspicious activities.

In addition to provisions targeting money laundering and corruption, the Act includes a significant offence: the ‘failure to prevent fraud’. This offence holds organisations accountable for fraud committed by their employees, agents, or representatives unless they can demonstrate that they have adequate policies and procedures to prevent such misconduct.

Under the legal framework, organisations that fail to take the necessary steps to prevent fraud within their ranks will face serious consequences. In addition to potential criminal prosecution, organisations found guilty of the ‘failure to prevent fraud’ offence could be subject to hefty fines, which could significantly impact their financial stability. Moreover, the reputational damage associated with being implicated in a fraud scandal could have long-lasting consequences for an organisation’s brand and standing in the business community.

Definition of Organisations Affected

The ‘Failure to Prevent Fraud’ offence, which will apply to large organisations, subsidiaries, partnerships, and not-for-profit organisations across all sectors, is valuable for promoting accountability, transparency, and ethical behaviour in business. The legislation aims to create a more responsible and ethical business environment that benefits all stakeholders by holding organisations accountable for their actions and ensuring compliance with the law.

Two of the three criteria below must be met for the ‘failure to prevent fraud’ offence to apply to an organisation:

- More than 250 employees

- More than £36 million turnover

- More than £18 million in total assets

The offence will also apply to parent organisations of a group which meets at least two of the following criteria in the final year preceding the year in which the offence is committed:

- More than 250 aggregate employees

- An aggregate turnover of over £36 million net (or £43.2 million gross)

- Aggregate balance sheet of over £18 million net (or £21.6 million gross)

The ‘Failure to Prevent Fraud’ offence is a step in the right direction towards ensuring accountability and transparency across all sectors. In today's globalised and interconnected world, organisations of all types and sizes must act ethically and responsibly to maintain trust and credibility with their stakeholders.

Applying the offence across all sectors is a significant step towards promoting a culture of ethical behaviour and compliance with the law. It sends a clear message that unethical conduct will not be tolerated, regardless of the industry in which the organisation operates. This will help to create a more level playing field and foster a business environment that values integrity and honesty.

More articles can be found at Procurement and Supply Chain Management Made Simple. A look at procurement and supply chain management issues to assist organisations and people in increasing the quality, efficiency, and effectiveness in the supply of their products and services to customers' delight. ©️ Procurement and Supply Chain Management Made Simple. All rights reserved.