The concept of an ‘associated person’ is a crucial aspect of this trend. An associated person can be broadly defined as anyone connected to an organisation or partnership in a way that allows them to act on behalf of the organisation. This includes employees, agents, subsidiaries, and individuals who perform services for or on behalf of the organisation.

For instance, if an employee of a large organisation commits a fraud offence, the potential consequences for the organisation are severe. The organisation may be held liable for their actions. This is because the employee is considered an associated person of the organisation, and their actions can be attributed to the organisation itself. Similarly, if a subsidiary’s employee commits a fraud offence for the benefit of the parent organisation, the parent organisation can be held liable if it did not take ‘reasonable’ steps to prevent the offence.

The Imperative for Fraud Detection and Prevention

The rationale behind this approach is straightforward. Large organisations have significant resources and influence and must ensure that their employees and subsidiaries operate lawfully and ethically. By holding organisations accountable for the actions of their associated persons, the law incentivises organisations to implement robust compliance measures and closely monitor the activities of their employees and subsidiaries.

However, it is essential to note that liability for the actions of associated persons is not automatic. To establish liability, it must be shown that the organisation failed to mitigate the ‘reasonable’ steps to prevent the fraud offence. What constitutes ‘reasonable’ steps will differ according to the circumstances of each case but may include measures such as conducting background checks on staff, providing training on ethical conduct, and implementing internal controls to prevent fraud.

Holding organisations liable for the actions of their associated persons in fraud offences represents an essential step towards ensuring accountability and ethical conduct in the business world. By making organisations responsible for the actions of their employees, agents, and subsidiaries, the law sends a clear message that only the highest ethical operating standards are acceptable. This shift in legal responsibility is a positive development that helps protect consumers, investors, and the integrity of the business community.

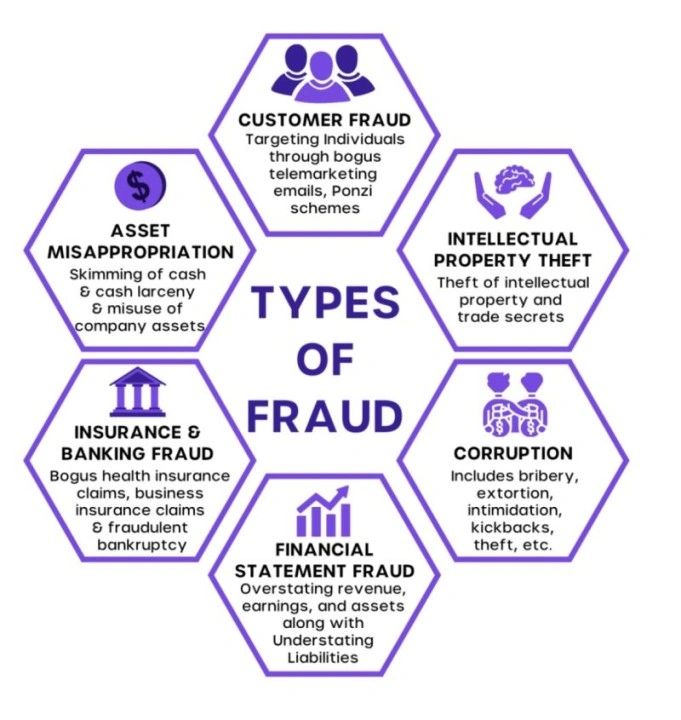

The Most Common Types of Fraud

The fraud offences outlined below are extensive and represent the types of fraudulent activities that frequently arise within large corporations and organisations:

- Common law - Cheating the public revenue.

- Organisations Act 2006, section 993 - Fraudulent trading.

- Theft Act 1968, section 19 - False statements by organisation directors.

- Theft Act 1968, section 17 - False accounting.

- Fraud Act 2006, section 2 - Fraud by false representation.

- Fraud Act 2006, section 3 - Fraud by failing to disclose information.

- Fraud Act 2006, section 4 - Fraud by abuse of position.

- Fraud Act 2006, section 11 - Obtaining services dishonestly.

- Fraud Act 2006, section 9 - Participation in a fraudulent business.

The Need for Organisational Action

Fraud prevention is a crucial aspect of running a successful and ethical business. Large organisations in the UK have long understood the importance of solid fraud prevention procedures to safeguard their reputation, assets, and stakeholders. With the ever-evolving landscape of financial crime and increasing regulatory requirements, it is imperative for organisations to continuously assess and enhance their fraud prevention measures to stay ahead of potential threats.

The UK Bribery Act, which came into force on 1 July 2011, was a significant milestone in the fight against corruption and fraud. One of the Act's key provisions was the introduction of the offence of 'failure to prevent' bribery. This meant that organisations could be held liable for corruption committed by their employees or agents unless they could demonstrate that they had adequate procedures to prevent such misconduct.

In response to the Bribery Act, many organisations in the UK have implemented robust financial crime control frameworks and procedures. These measures are designed to deter, detect, and prevent fraud, bribery, and other forms of economic crime. However, the threat landscape is constantly evolving, and fraudsters are becoming increasingly sophisticated in their methods. Therefore, it is essential for organisations to regularly review and enhance their fraud prevention measures to adapt to threats and vulnerabilities.

Organisational Fraud Prevention Policies and Procedures

The importance of having robust fraud prevention procedures in place cannot be overstated for large organisations in the UK. The UK Bribery Act and other regulatory requirements have clarified that organisations must proactively prevent fraud and corruption. By regularly reviewing and enhancing their fraud prevention measures, organisations can better protect themselves and their stakeholders from the risks posed by financial crime. Organisations must stay vigilant and proactive in the fight against fraud to maintain their integrity and reputation in the market.

The government's guidance on 'adequate procedures' to prevent bribery was based on a risk-based approach to compliance, which featured six fundamental principles. These principles are designed to be flexible and should be tailored to fit the organisation's specific context, including its size, the products and services it offers, and other relevant factors. Ultimately, the procedures implemented by an organisation must be suitable and commensurate with the distinct risks it encounters. These six principles are as follows:

- Principle 1: Proportionate Procedures.

- Principle 2: Top-Level Commitment.

- Principle 3: Risk Assessment.

- Principle 4: Due Diligence.

- Principle 5: Communication (including training).

- Principle 6: Monitoring and Review.

These principles provided a roadmap for organisations to develop and implement effective fraud prevention measures. Considering the ongoing challenges of fraud and financial crime, a regular review is appropriate for organisations to revisit their existing fraud prevention measures and enhance them where required. This could involve conducting a comprehensive review of their current procedures, identifying gaps and weaknesses, and implementing controls and safeguards to strengthen their defences against fraud.

(125)%206.jpg/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:1280)

Enhancing Fraud Prevention Policies and Procedures

A good starting point for organisations looking to enhance their fraud prevention measures is to adopt a risk-based approach modelled on established principles. Organisations can tailor their prevention strategies by identifying and assessing potential operational risks to address the most pressing concerns. This proactive approach strengthens internal controls and ensures that resources are allocated effectively to prevent fraudulent activities.

One essential step an organisation can take to drive positive corporate behaviours and enhance fraud prevention measures is establishing a robust ethical culture. By fostering a culture of integrity and transparency, organisations can create an environment where employees are more likely to report suspicious activities and uphold ethical standards. This can help deter fraud and misconduct before they escalate into a more significant issue.

Another essential measure organisations can take to prevent fraud is implementing robust internal controls and monitoring systems. Organisations can identify potential vulnerabilities by regularly reviewing and updating internal controls and taking proactive steps to mitigate risks. This may involve conducting regular audits, implementing segregation of duties, and monitoring transactions for irregularities.

In addition to internal controls, organisations can also benefit from investing in fraud detection technologies and tools. Advanced analytics and monitoring systems can help organisations identify patterns and anomalies indicating fraudulent activities. By harnessing the power of technology, organisations can improve their ability to detect and prevent fraud in real time.

Furthermore, organisations can enhance their fraud prevention measures by providing ongoing training and education to employees. By raising awareness of the risks associated with fraud and misconduct, organisations can empower employees to recognise and report suspicious activities. Training programs can also help employees understand their role in preventing fraud and maintaining a culture of integrity within the organisation.

More articles can be found at Procurement and Supply Chain Management Made Simple. A look at procurement and supply chain management issues to assist organisations and people in increasing the quality, efficiency, and effectiveness in the supply of their products and services to customers' delight. ©️ Procurement and Supply Chain Management Made Simple. All rights reserved.